Table of Content

So choose carefully how much money you want to go to your card vs. how much you want to get back when your Credit Builder Account ends. At Bankrate, we take the accuracy of our content seriously. This site is protected by reCAPTCHA and the GooglePrivacy Policy and Terms of Service apply. Credit limit increase or decrease will be reflected on the next billing cycle.

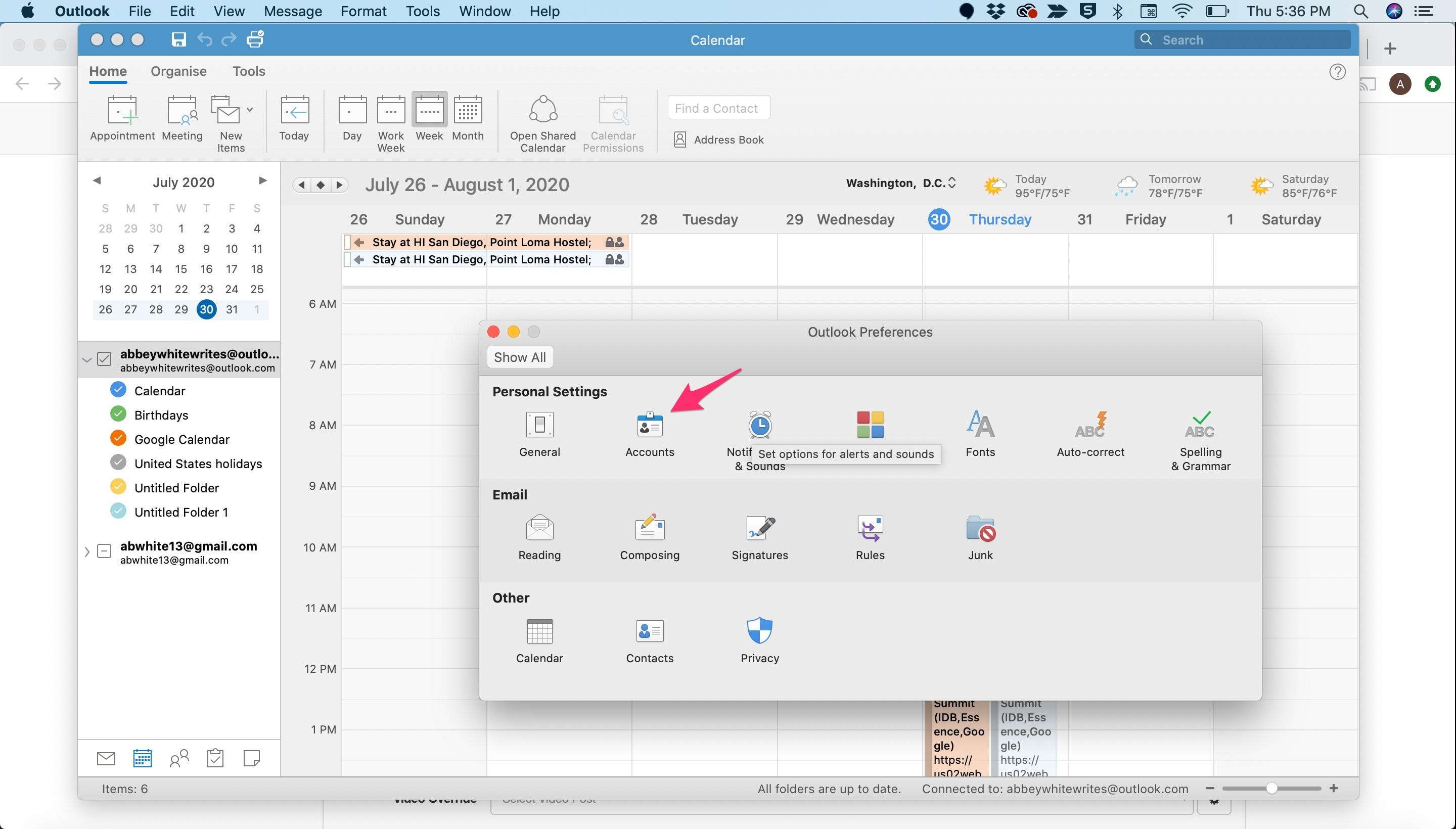

Some credit cards may decline your transactions if you try to spend more than the remaining balance. But if the transaction goes through, this can put you over your credit card limit and you may be charged a fee, also known as an over-limit transaction fee. To help avoid going over your credit limit, you may be able to set up an alert with your card issuer. If you want to increase your credit limitwith your Home Depot credit card, there are a few steps to follow. You will need to email customer service, which can be found in their "Help & Contact Us" menu located at the top right corner of their website.

Everything You Need to Know About the Self Credit Card Limit

If you have new or limited credit history, pay down your balances by paying more than the minimum payment each month. We are fast, easy, and successful at helping consumers request a credit limit increase with their credit card issuer. The Capital One Lounge and Priority Pass Lounge access are great too, though the Capital One Lounge system is brand new and has limited locations so far. The $100 TSA PreCheck or Global Entry reimbursement credit, a lack of foreign transaction fees and the dozen plus travel loyalty program points transfer options are great, too.

Starting off with a lower-than-desired credit limit is, unfortunately, not uncommon. For large purchases requiring a higher limit, consider options with a 0% introductory APRs on purchases. These cards will enable you to make a purchase and pay it off over time without accruing interest right away. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Credit limit and income

To view the list of our payment partners, please click here. You will receive an SMS from us if you need to claim your credit card from the courier office nearest you. Your credit card will be delivered to your delivery address within 5 working days if the address is within Metro Manila, or 10 working days for provincial areas. You will receive an SMS notification once your card is ready for delivery.

Free first checked bag – a savings of up to $140 per roundtrip. Forbes Advisor created additional star ratings so that you can see the best card for specific needs. This card shines for this use, but overall the star ratings may differ when compared to other cards. Get a welcome coupon to use on your next purchase and a birthday coupon. We’ll hold onto this deposit as long as your Self card is open.

What is conversion fee?

You will see there your card details, balances, limits and transaction history. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Power its potential with one of our business credit cards, like Ink Business Preferred℠, Ink Business Unlimited℠ or Ink Business Cash℠.

In most cases, you won’t be asked to verify your income, but if you are, you can provide proof with pay stubs or tax returns. Some lenders may ask you at regular intervals whether your income has changed to ensure their records are up to date. Applicants 18 to 21 years old can also report income from financial aid . Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.

He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. Earn Chase Ultimate Rewards® on everyday purchases and redeem for travel, cash back and more. See all our rewards credit cards and choose one that’s right for you.

The more you’ve shown that you regularly pay your credit card balances, the more likely creditors are to give you a credit card with a lower rate and a higher limit. If you have a $1,000 credit card balance and a $2,000 credit limit, you have 50% utilization, which is pretty high. Here are three ways you could potentially increase your Self credit card limit. As of January 2021, the maximum secured credit limit available on the Self card is $3,000 for eligible customers. That means the maximum amount you can move from your Credit Builder Accounts to the Self card over time is $3,000.

We're going to show you what steps to follow to increase your limit and how using DoNotPay can make the process go a lot more smoothly. Avoid late payments by tracking your bills and setting up automatic payments or payment reminders. Strive to only use around 30 percent of your ~, since that's a major factor in determining your credit score. If you’re trying to consolidate your debt to a single card via balance transfer, consider only those cards with a 0% introductory APR on balance transfers. However, to maximize the earnings potential on this card you need to keep at least $1,000 daily balance in an Alliant checking account. The card charges no foreign transaction fees and offers travel protections like trip cancellation coverage and lost and damaged luggage coverage.

A credit card limit is the total amount of money you can charge to a credit card. If your credit card has a limit of $5,000, for example, it means you can carry a balance of up to $5,000 on your credit card. Your credit card limit includes both new purchases and balance transfers—as well as any other transactions that draw against your line of credit, such as cash advances. Even your annual fee is charged against your total credit limit.

How you've handled credit limits on your other credit cards will not only affect whether you get approved for a new credit card but also the credit limit you'll be approved for. Late payments, high balances, and other negative information make it less likely that you'll be approved for a high credit limit. When you’re approved for a new credit card, the issuer will decide on a credit limit for your account.

If you're applying jointly with another person, the credit card issuer will consider both of your incomes and credit qualifications to set your credit limit. The amount of money you make generally affects the amount you can afford to pay. While you have a better chance of getting approved for a higher credit limit if you have a high income, there's no guarantee that your income will get you a high credit limit. Other factors, like the type of credit card, still come into play.